What is the current buyer profile in real estate in Spain

“More trusted in the future, more willing to buy, with a bigger budget and more financially solvent.”

Affirmation that matches both Eloy Bohúa, director of Planner Exhibitions (the organizers of SIMA fairs to help thousands of visitors find a property) and Juan Fernandez-Aceytuno, director general of the Society of Taxation (ST) .

Still, the pressure affect the buyer receives versus the price of housing, a fact that should not be forgotten.

All these data are collected in an annual report analyzing the behaviors and expectations of these, based on a series of satisfaction surveys of visitors to the fairs SIMA. The report The homebuyer profile.

The homebuyer profile.

Age homebuyer

As we can see in this graph, the homebuyer profile comprising the age group of 25-35 years is the largest in recent years. Stable over the last three years but down if you look at 2011 data.

All this land has been transferred to a profile bought from an age of 36-45 years. We can say that this strip is the true strength of demand for buying a home. Coinciding with the recovery of the sector, this buyer profile up 7 points from the last survey.

The band of more than 45 years hampered its evolution losing 7 points, if you look at its evolution since 2013.

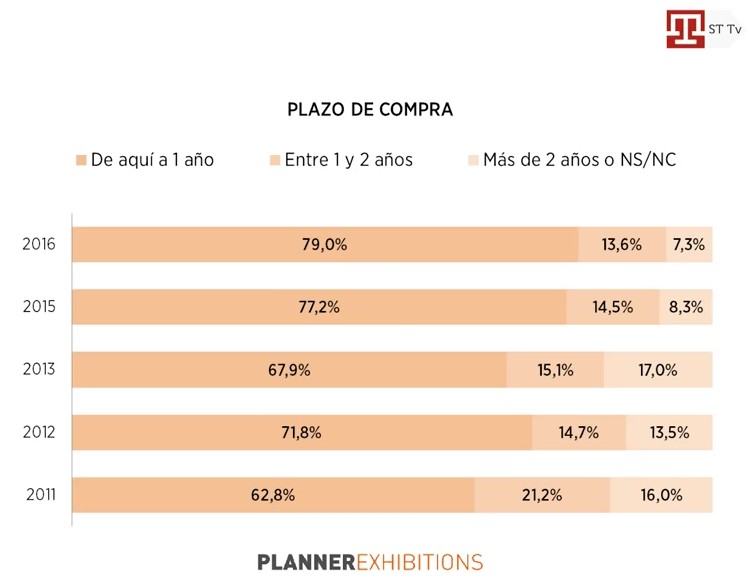

When do you intend to buy a home?

The mentality in the Spanish housing market for buyers is to end up owning a property. That’s why according to surveys and market trends, 79% think materialize within homebuying in 1 year. A two-point increase over last year but 13 points over 2013.

What is the budget for buying a home?

Between 150,000 and 300,000 € budget the largest bulk of surveyed, accurately the 52.8%. Although we see as relevant fact that 27.1% of surveyed who have a purchasing budget of € 300,000 over 14 points higher compared to 2013, remaining close to data from before the financial crisis of 2008.

Still, there are fewer who can take on the entire purchase and increasingly, those who have to finance more than 80% of the total cost.

Regrows the possibilities of obtaining financing for the purchase of housing.

After years of stagnation, it appears to be light at the end of the tunnel in which to obtain financing for the purchase of a property is concerned. Nearly 83% would get the funding to take the purchase of the property, about 23 points over just 5 years ago.

If this article has seemed interesting, we recommend these entries of the real estate investments.